Bringing the conversation back to banking

12 September 2017 - Natalie Simpson

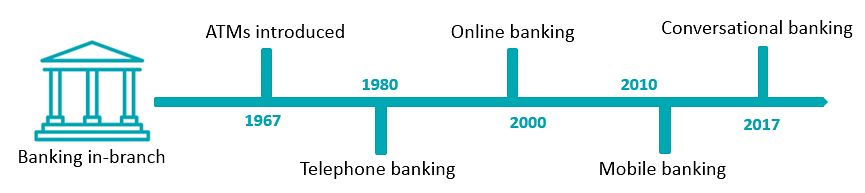

The arrival of the digital age has disrupted the retail banking industry and changed the relationship between us and our banks. Where banking once meant going into our local branch and interacting with people face to face, digital channels like websites and apps have opened up an entirely new way of doing things. Online banking has allowed us to access our finances like never before – at the touch of a button. But has this convenience come at the cost of the traditional conversation?

Across the financial sector, big banks (see below) are investing heavily in conversational technology and rolling out chatbots to their customers. But, can bots make the digital banking experience simpler, more personal or even more human? Here at User Vision, we have been looking at our top 5 benefits bots can bring to banking.

Chatbots – the lowdown…

Chatbots are software that live in messaging apps such as Facebook Messenger. They respond to natural language commands or queries from users in a human-like way – just like having a conversation with a friend. Currently, they can perform simple tasks such as checking the weather, ordering food or booking a flight via sending a series of short messages.

In the future, they will be powered by Artificial Intelligence (AI), but for now, most are relying on decision tree logic. However, even in their current form, bots can add value for users, by performing simple tasks well.

For more on how chatbots work see part 2 of our blog series ‘The rise of Conversational Interfaces’.

1. Re-establishing relationship banking & re-engaging users

Having our finances at our fingertips with mobile banking is certainly accessible and quick, but for the most part, interaction does tend to flow one way – from the customer to the bank. Banking sites and apps can be complex which means clicking on menus and links or filling out forms in order to get the information we need.

Should we have an issue that needs resolving, interacting with call centre staff is often the last resort, as often we’re all too busy to sit on the end of the phone waiting to be connected. Gone is the two-way traditional customer relationship, it is now, for the most part, the customer’s responsibility to get in touch with the bank to get the information they’re after.

Enter chatbots – there’s now an opportunity to include human interaction in design where it was lacking with websites and apps. Bots can initiate contact and re-engage customers with conversation. It’s time to bring back relationship banking.

Banking bots will be able to send a quick reminder on Messenger about an important payment to be made or a message about a new financial product, tailored to our needs. Sounds good to us, where do we sign up?

2. Instant & accessible customer service

Chatbots live in messaging apps, so users will be able to access their financial information using familiar interfaces they already use daily. There is no need to learn a new UI or even open more than one app. We already use messaging apps like Facebook Messenger, so they know our personal details – there’s no need sign up or log in each time.

Customers call banks for a variety of reasons, many of which can be automated and don’t necessarily need call centre staff to engage with users over the phone.

Experience shows that 99% of tasks(this will open in a new window) users want to carry out with online banking can actually be narrowed down to 3 simple use cases, perfect for bots with finite responses. These include:

- Checking balances

- Checking recent transaction history

- Transferring money

Customers will be able to simply ‘ask’ the bot through their messaging app ‘pay my rent’ and the money will be transferred seamlessly. Or, ‘direct debits this month’ and the chatbot will show the relevant information instantly.

Quicker and easier access to our finances translates to higher engagement and loyalty – or so banks are hoping.

3. Data Insights

Banks have a huge collection of customer data at their fingertips but often struggle to understand and get value out of it. Now that customers rarely have face-to-face conversations with tellers about the details of their finances, acquiring and understanding customer data is crucial.

Chatbots are excellent data analytics tools as they operate by serving customers with answers based on context, specific questions, and keywords. They can give a bird’s eye view of the customers current needs and pain points not apparent from banking app and website interactions alone. This is the key to establishing meaningful, personal relationships with banking customers, offering personalised products and experiences. There is a huge potential here to pull data on spending and push out tailored offers and promotions to customers.

4. Increased Operational Efficiency

Some of the areas bots can help with:

- Automating basic tasks such as, answering FAQs, providing balances and opening new accounts – freeing up humans to deal with the more complex.

- Maintaining call centres to handle customer support is one of the costliest of banking operations. Using bots allows banks to reduce overall call centre volume as well as mean a reallocation of funds from call centres to other areas of the business.

- Bots don’t need holidays or mind working 24 hours a day, 365 days a year. In fact, when it comes to customer service these days, this is what people expect.

5. Attracting the millennials

As younger, digitally native clients begin moving into the market for financial services, at both a consumer and personal level, becoming ‘digital first’ is a must for the banking industry. If banks want to attract millennials, they need to be where they are – on instant messaging platforms.

82% of smartphone owners between 18–24(this will open in a new window) use mobile banking and have grown up using messaging apps daily. They are very aware of options available to them and can quickly shop the digital experience that meets their needs for any financial services solution.

53% of millennials don’t think that their bank offers anything different to other banks.

Banks who talk to their customers where they are will not only have a competitive edge, but those who don’t develop this technology will be in the minority and the ones who lose out.

Conclusion

It’s easy to see why big banks are investing in chatbots. Offering improvements to both back-office and consumer-facing operations, they are a simple, scalable solution to many of the common digital banking problems we see today. Chatbots are able to extract and analyse a user’s needs and intent, returning the information requested instantly, at any time of day, more accurately and at a significantly lower cost to human counterparts.

Today’s customers expect world-class digital services across all industries. Chatbots not only meet these expectations but give significant advantages to banks that offer them to their customers.

It’s time for banks to bring two-way, relational interactions to digital banking channels and with advancements in technology and messaging apps trend, interacting with customers through the most natural medium, conversation looks to be the best solution.

You might also be interested in...

Understanding Accessibility Drift - And How to Prevent It

12 February 2026Why accessibility standards erode after audits, and what continuous monitoring can do about it.

Read the article: Understanding Accessibility Drift - And How to Prevent ItAI can design a screen, but it still can’t feel one!

16 January 2026This article has been inspired by conversations between Paul Duffy, MD of Zudu, the AI enabler for businesses, and Chris Rourke, Founder and Executive Director of User Vision, and by the learning they each took from each other’s perspectives on how AI can support UX and Design.

Read the article: AI can design a screen, but it still can’t feel one!Accessibility Toolkit - Access360 Managed Service

5 January 2026Continuous WCAG monitoring, expert audits, and capability building to maintain sustainable digital accessibility .

Read the article: Accessibility Toolkit - Access360 Managed Service