Consumer Duty Compliance: Measuring Outcomes That Matter

4 March 2025 - Stephen Denning

In our previous article on Consumer Duty, we explored how organisations could leverage human-centred design to prepare for the FCA's Consumer Duty legislation. Now, as the financial services industry adapts to this new reality, it's evident that traditional customer satisfaction metrics are no longer sufficient. Financial institutions must now provide ongoing evidence of delivering positive outcomes for their customers, not just selling products and services.

The Shift in Consumer Outcome Measurement

At the core of Consumer Duty compliance lies the need for a robust framework to monitor and measure consumer outcomes. This goes far beyond tracking basic customer satisfaction scores. The challenge for financial services businesses is twofold: collecting the right data and interpreting it to understand customer experiences and well-being.

Why Traditional Metrics Fall Short

Many companies still rely on conventional metrics like Net Promoter Score (NPS) or general customer satisfaction surveys. While these tools have their place, they often fail to capture the full spectrum of consumer experiences, particularly when it comes to identifying potential harm or dissatisfaction.

These metrics are often difficult to action. Many organisations we speak to lack a clear plan to address drops in NPS scores, often due to the broad scope of NPS questions or the absence of specific reasons for dissatisfaction. Consumer Duty demands a more nuanced and robust approach that can uncover underlying issues invisible to traditional measurement techniques

Strategic Approach to Outcome Measurement

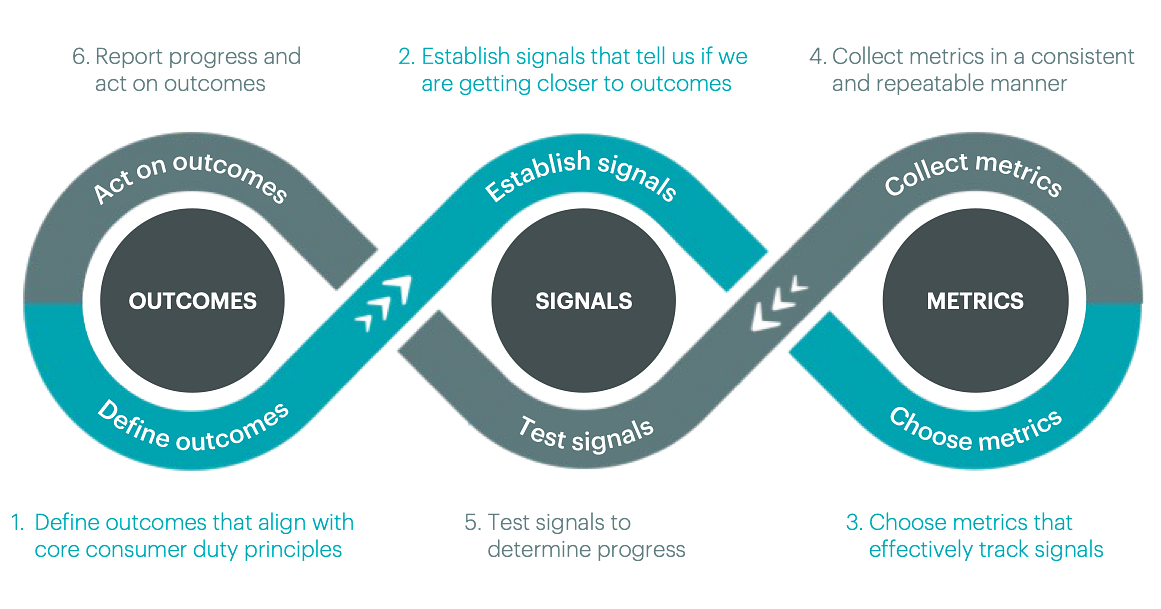

Establishing a measurement framework aligned with Consumer Duty requires a strategic approach to consumer outcome measurement. This process involves:

- Defining clear outcomes that reflect Consumer Duty principles (fairness, transparency, customer-centricity)

- Establishing specific, measurable signals to track progress towards these outcomes

Using these signals as a focus, teams should only then identify the right metrics – ones which not only measure the values described in the outcomes but are ultimately actionable. This could involve developing new KPIs that go beyond sales or satisfaction, focusing instead on consumer experience, engagement, financial well-being, and the suitability of products and services over time. We call these Key Experience Indicators, or KEIs.

Implementing Key Experience Indicators (KEIs)

Key Experience Indicators (KEIs) play a vital role in Consumer Duty compliance. These metrics go beyond sales or satisfaction, focusing on:

- Consumer experience

- Engagement

- Financial well-being

- Product and service suitability over time

By integrating KEIs into outcome measurement strategies, financial services companies can better ensure compliance with FCA standards and consistently deliver positive customer experiences.

Tactical Implementation for Consumer Duty Compliance

Once the framework is in place, tactical execution becomes crucial. Companies need to:

- Establish systems for continuous monitoring

- Collect data from multiple sources (customer interactions, complaints, UX/CX studies, social media)

- Analyse data in real-time to identify trends and potential risks

- Conduct regular root cause analyses when poor outcomes are identified

This approach ensures that companies not only address immediate problems but also prevent them from recurring, fostering a culture of continuous improvement.

Transparent Reporting and Continuous Improvement

Finally, transparency in reporting is critical for Consumer Duty compliance. Financial institutions must be prepared to demonstrate to the FCA - and to their customers - that they are actively monitoring outcomes and taking steps to improve them. A strategic framework enables reporting that makes it easy to share insights with stakeholders, ensuring accountability and a focus on continuous improvement.

How User Vision Can Help

In today's evolving regulatory landscape, understanding and improving the consumer experience is no longer optional - it's essential for Consumer Duty compliance. With 25 years of expertise, User Vision is uniquely positioned to help financial services businesses exceed the FCA's Consumer Duty standards.

By partnering with User Vision, you can:

- Establish a culture of continuous improvement, where user experience is at the forefront of every decision

- Align your services with user needs

- Enhance the usability of customer touchpoints

- Ensure equitable access for all users

We provide the strategic and tactical support necessary to build a robust, repeatable model for measuring and improving consumer outcomes in line with Consumer Duty requirements.

Take Action Today

To ensure your organisation is prepared for ongoing Consumer Duty compliance and to develop a strategic outcome measurement framework, contact Arthur Moan, our Client Services Director, at arthur@uservision.co.uk. Let User Vision guide you in mastering Consumer Duty outcome measurement and delivering positive consumer experiences.

You might also be interested in...

Why Your Usability Tests Are Failing: The Hidden Pitfalls That Mislead Teams

25 February 2026Many teams run usability tests that quietly mislead them—this article exposes the hidden pitfalls in planning, moderation and analysis, and explains how to fix them.

Read the article: Why Your Usability Tests Are Failing: The Hidden Pitfalls That Mislead TeamsUnderstanding Accessibility Drift - And How to Prevent It

12 February 2026Why accessibility standards erode after audits, and what continuous monitoring can do about it.

Read the article: Understanding Accessibility Drift - And How to Prevent ItAI can design a screen, but it still can’t feel one!

16 January 2026This article has been inspired by conversations between Paul Duffy, MD of Zudu, the AI enabler for businesses, and Chris Rourke, Founder and Executive Director of User Vision, and by the learning they each took from each other’s perspectives on how AI can support UX and Design.

Read the article: AI can design a screen, but it still can’t feel one!